What Is Title Insurance? Protect Your Property Today

When you're buying a home, you're not just getting the keys to a physical building; you're acquiring the legal right to own it. This right is called the "title," and title insurance is the crucial safety net that protects your claim to it.

Unlike homeowner's insurance, which covers you for future disasters like a fire or a storm, title insurance protects you from the past. It's your financial shield against hidden issues tied to the property's history—problems that existed long before you ever saw the "For Sale" sign.

Your Guide to Understanding Title Insurance

Think of it this way: even the most detailed home inspection can't uncover legal skeletons hiding in decades of public records. These issues, known as title defects, can pop up years after you've moved in, threatening your ownership and costing you a fortune in legal fees. Title insurance helps to protect you from these title defects on the property.

It's a one-time fee paid at closing that defends you and your lender against these exact kinds of problems.

Why Is Title Insurance So Important?

A clean, clear title is the bedrock of secure homeownership. Without it, you could find yourself in a nightmare scenario, fighting costly legal battles or, in the worst cases, even losing your home. This is where a professional title office, such as a trusted local firm like Ross Title, Inc., becomes invaluable. They take care of all the work for you.

Their team dives deep into historical records, performing an exhaustive title search to uncover and resolve any potential red flags before you sign on the dotted line. This specialized insurance protects you from a whole host of potential headaches, including:

- Undiscovered Liens: Unpaid bills from a previous owner's contractor or overdue property taxes that have become a claim against the property.

- Forged or Fraudulent Documents: Illegitimate deeds or other fake filings that could challenge the legality of your ownership.

- Ownership Claims: Unexpected disputes from a previously unknown heir or an ex-spouse of a former owner.

- Clerical Errors: Simple mistakes or typos in public records that can create a massive cloud over your title.

While owner's title insurance isn't required, many title companies will charge the same settlement fees whether you get the title insurance or not. This makes the protection a high-value investment for a minimal extra cost.

To give you a clearer picture, here's a quick rundown of what title insurance really means for you as a homebuyer.

Title Insurance at a Glance

| Concept | What It Means for You |

|---|---|

| Past vs. Future | Protects against events that already happened in the property's history, not future incidents. |

| One-Time Fee | You pay for it once at closing, but its protection lasts for as long as you own the property. |

| Title Search | A deep dive into public records to find liens, errors, or ownership disputes before they become your problem. |

| Peace of Mind | Your assurance that your claim to the property is secure and defended against legal challenges. |

Ultimately, having this protection in place allows you to enjoy your new home without worrying about ghosts from its past coming back to haunt you.

Navigating the world of real estate can be complex, and getting the fundamentals right is everything. Understanding a key protection like title insurance is a major part of the essential guide on how to buy like a pro. It's the kind of decision that provides lasting peace of mind, ensuring the beautiful home you've worked so hard for is truly, and legally, yours.

How the Title Search Process Protects You

So, how exactly does title insurance shield your investment from nasty surprises? It all starts with a meticulous investigation called a title search. This isn't just a quick Google search; it's a comprehensive deep dive into the property's complete legal history, handled by a professional title company.

The whole point is to hunt down and fix any issues, known as title defects, long before you get the keys. Think of it as a detailed background check on your future home. Title experts pour over decades of public records, scrutinizing every document connected to the property to make absolutely sure the seller has the clean, undisputed right to sell it to you.

What Experts Look for in a Title Search

This process is incredibly thorough. A local title office, like Ross Title, Inc., takes care of all the work for you, examining a huge range of official documents. Their one and only mission is to clear the runway for a safe and secure closing.

Here are a few key things they're looking for:

- Deeds and Ownership Transfers: They meticulously trace the "chain of title," making sure every single ownership transfer from one person to the next was legal and properly recorded. Any broken link in this chain is a major red flag.

- Tax Records: The search confirms all property taxes are paid and current. An unpaid tax bill can lead to a lien, which means the government could have a claim against your new property.

- Court Judgments and Liens: Experts scan for any outstanding lawsuits, liens from contractors who weren't paid for their work, or other judgments against past owners that could latch onto the property.

- Easements and Encumbrances: They identify any legal rights other people or companies might have to use a part of your property, like a utility company needing access to its power lines.

At its core, title insurance helps to protect you from title defects on the property. By uncovering these issues proactively, the title search process ensures that by the time you receive the keys, the title is clean and your investment is safe from past complications.

This preventative step is what makes title insurance so powerful. It’s all about eliminating risks before you get to the closing table, giving you the peace of mind that the home you're buying is free and clear of any hidden legal baggage.

Uncovering Common Hidden Property Risks

Most homebuyers go into a purchase assuming the property’s history is squeaky clean. The reality? Hidden ownership risks are far more common than you might think. While a good title search uncovers most issues, some problems are buried so deep in the past they only surface years after you've unpacked the last box.

This is exactly why owner's title insurance is so crucial. It’s your shield against very real threats that could put your entire investment on the line. These aren't just abstract legal ideas; they're real-world headaches that can turn the dream of homeownership into a financial nightmare. A local title office, like Ross Title, Inc., takes care of all the work for you, but some defects are simply impossible to spot in public records.

Real-World Threats to Your Property Title

Imagine finding out a signature on a deed from 30 years ago was a forgery. That one fraudulent act could invalidate the entire chain of title, putting your legal ownership in question. Without title insurance, you’d be on your own, footing the bill for a costly legal battle just to defend what you thought was yours.

Other common hidden risks pop up all the time:

- Contractor Liens: A previous owner hired a company for a big renovation but skipped out on the final payment. That contractor can slap a lien on the property, and suddenly, their unpaid bill could become your problem.

- Unknown Easements: You might discover a neighbor has a legal right—an easement—to build a driveway straight through your new backyard. It's the kind of thing that should have been disclosed but sometimes isn't.

- Undisclosed Heirs: A long-lost heir of a former owner could appear out of nowhere with a legitimate claim to the property. This can spark a complex and expensive legal fight over who truly owns the home.

A simple clerical error or a fraudulent signature from decades ago can create a title defect that jeopardizes your investment. Title insurance helps to protect you from these unforeseen title defects on the property.

These scenarios really underscore why understanding what things you shouldn't do when buying a home, like skipping owner's title insurance, is so important. While title insurance isn't required for the buyer, the peace of mind it offers is invaluable. In fact, many title companies will charge the same administrative fees whether you get the policy or not, making the small extra premium a very wise investment for lifelong security.

Owner’s Policy vs Lender’s Policy

When you’re buying a home, one of the most common points of confusion is the difference between an owner's policy and a lender's policy for title insurance. While they both deal with protecting the property's title, they serve completely different purposes and protect different people. Getting this straight is key to making sure your investment is actually secure.

Let's break them down.

Owner's Policy vs. Lender's Policy

Here’s a simple table to show who is protected and what’s covered with each policy.

| Feature | Owner's Policy | Lender's Policy |

|---|---|---|

| Who is Protected? | You, the homeowner. | The bank or mortgage lender. |

| Is it Required? | Optional, but highly recommended. | Almost always required for a mortgage. |

| What is Covered? | Your full equity and purchase price. | The outstanding loan amount only. |

| How Long Does it Last? | As long as you or your heirs own the property. | Until the mortgage is paid off. |

| Payment | A one-time fee paid at closing. | A one-time fee, often rolled into closing costs. |

As you can see, the two policies have distinct roles. The lender's policy is all about the bank, while the owner's policy is your personal safeguard.

Protecting Your Own Investment

A lender’s policy is almost always mandatory if you're getting a mortgage. This policy exists for one reason: to protect the bank’s financial stake in your property. It covers the loan amount and ensures the lender can get its money back if a title problem pops up down the road. But its protection stops there—it does nothing for you.

An owner’s policy, on the other hand, is what protects you, the buyer. While it isn't required by law, skipping it is a huge gamble with your down payment and your growing equity. This policy covers the home's full purchase price and defends your right to the property for as long as you or your heirs own it. A local title company, like Ross Title, Inc., takes care of all the complex work to put this protection in place for you.

Relying solely on the lender's policy leaves your own financial stake completely exposed. An owner’s policy is your personal shield against hidden title defects that could lead to devastating financial loss.

Interestingly, many title companies charge the same administrative fees at closing whether you get an owner's policy or not. This makes the one-time premium an incredibly high-value investment for securing your most significant asset.

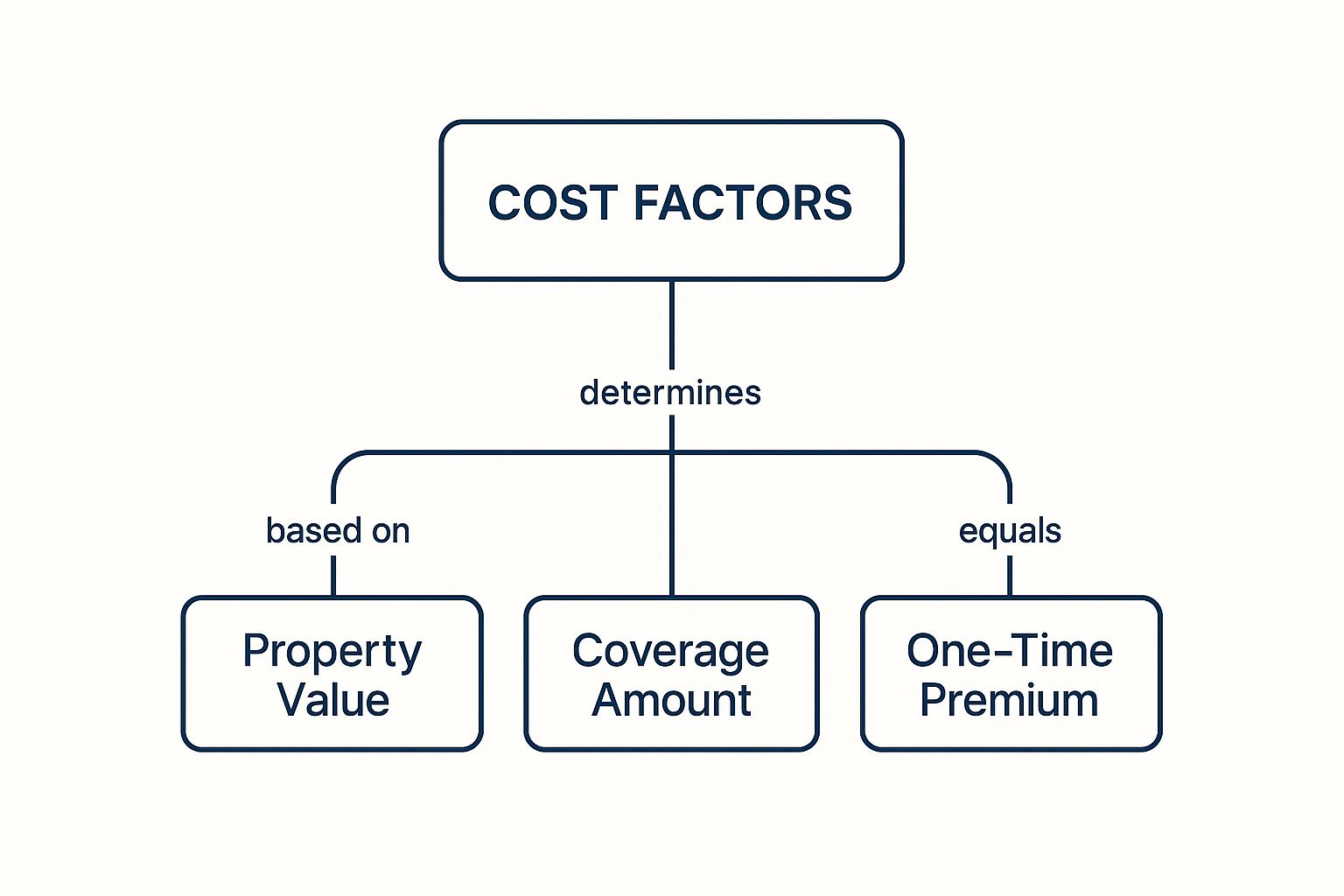

The infographic below shows the key factors that influence the one-time premium for your title insurance coverage.

As you can see, the cost is tied directly to the property's value, which ensures your coverage is perfectly scaled to your investment.

Understanding the Cost of Title Insurance

When people first learn about title insurance, one of the first questions they always ask is, "Okay, so what does it cost?"

Unlike your homeowner's insurance or car insurance that comes with a monthly bill, title insurance is a one-time premium you pay at the closing table. That single payment protects you for as long as you or your heirs own the property. It's lifelong security for what is likely your biggest asset.

The cost itself is tied directly to your home's purchase price. So, a higher-value property will have a higher premium, which makes sense—it ensures your coverage is scaled properly to your investment. You can easily see how this one-time expense fits into your overall budget by using a mortgage calculator to plan your closing costs.

The Value Behind the One-Time Fee

Here's something many homebuyers don't realize: the real value you get for that fee. An owner's policy is technically not required, but here’s the catch—title companies will charge the same settlement and administrative fees whether you get the title insurance or not. The heavy lifting of researching and clearing the title has to be done regardless.

This means the actual cost of adding the protective policy is often much less than you'd think. Skipping it to save a relatively small amount leaves you completely exposed to potentially catastrophic financial loss down the road. The premium is really what backs up all that upfront research with an actual guarantee.

Choosing to purchase an owner's policy transforms the standard closing process into a long-term shield for your property rights. This single payment is a small price for the peace of mind that comes with knowing your investment is secure from hidden, past issues.

A great local title office, like Ross Title, Inc., takes care of all this complex work for you, making sure your transaction is smooth and secure from day one.

Why Title Insurance Is Crucial for Florida Homebuyers

When you're investing in a property in a booming market like Southwest Florida, title insurance isn't just another line item on the closing statement—it's an essential shield for your investment. Our region’s history is full of rapid development, complex land subdivisions, and properties changing hands many times over. This creates a fertile ground for hidden title defects to pop up unexpectedly.

For the kind of high-value homes found in exclusive communities like Naples or Marco Island, the financial stakes are enormous. A single, undiscovered issue with the title could lead to devastating financial consequences down the road. This is where title insurance steps in, protecting you from past problems that could cloud your ownership rights. When you work with a skilled local title office, like Ross Title, Inc., they take care of all the deep-dive research for you, ensuring your peace of mind is secure from day one.

Florida-Specific Risks and Why They Matter

The Sunshine State has its own unique set of property quirks that make title insurance even more critical. It’s not uncommon for boundary disputes to arise from decades-old surveys, and claims from complicated inheritances or long-lost heirs are more frequent than many homebuyers realize. These are the kinds of Florida-specific risks that underscore why securing a perfectly clear title is the foundation of any safe real estate purchase.

You can see just how important this protection is by looking at the numbers. In the U.S., total title insurance premiums hit $3.9 billion in the first quarter of the year, which was an 18% jump from the previous year. What's telling is that Florida ranked second in the entire country, with $448 million in premiums. That figure really highlights our state's incredibly active market and the recognized need for this protection. You can dig deeper into the title insurance premium data from ALTA.

In a market where title companies will charge the same administrative fees whether you purchase the insurance or not, the decision becomes simple. The small additional cost provides an impenetrable shield for your most valuable asset.

Ultimately, this one-time fee protects you from any lingering issues from the past that could threaten your future enjoyment and ownership of the property. That makes it a non-negotiable part of any luxury real estate transaction here in Southwest Florida.

Common Questions About Title Insurance

To wrap things up, let's go over a few common questions homebuyers have about title insurance. Getting clear answers now will help you head to closing day with total confidence.

The Lender Has a Policy, So Why Do I Need My Own?

This is a really important distinction that trips a lot of people up. The lender's policy is purely for their own protection—it only covers their financial stake in the property, meaning the loan amount. It does absolutely nothing for you.

An owner's policy is your personal shield. It protects your down payment, your growing equity, and your legal right to actually own the home. Without it, your entire investment is exposed.

How Long Am I Covered By My Title Insurance?

This is one of the best parts about an owner's policy. Your coverage lasts for as long as you or your heirs own the property. It’s a one-time fee you pay at closing that gives you a lifetime of security against title problems from the past. You get lasting peace of mind for a single payment.

If someone ever files a claim against your title down the road, your insurance company steps right in. They will cover the legal fees to defend your ownership and pay for any financial losses you might face, all the way up to the full value of your policy.

What Actually Happens if Someone Makes a Claim?

Let's say a hidden issue finally comes to light—maybe an unknown heir shows up with a claim, or a lien from a previous owner's unpaid contractor suddenly appears. This is exactly when your title insurance policy kicks in.

All you have to do is notify your title insurer, and they take over the entire legal headache. A great local title office, like Ross Title, Inc., makes sure all this is set up correctly from day one. They take care of all the work for you, which not only makes for a smooth closing but also secures your long-term protection.

Navigating the Southwest Florida real estate market requires local expertise and confidence in your investment. For personalized guidance on finding the perfect luxury home or positioning your property for a successful sale, trust the team at Gulf and Greens Luxury. Explore your options and secure your dream home today. https://www.gulfandgreensluxury.com

Article created using Outrank